In the current times of COVID-19, a lot has changed in the tax world; due dates of tax returns, some states not changing their estimated payment schedules, understanding the SBA Payroll Protection Program, changes to 2018 Qualified Improvement Property treatment and potential future tax law changes. One thing which hasn’t changed is the fact that the Oregon Corporate Activity Tax is going into effect, and that it impacts ALL types of taxpayers (Yes, even rental companies). In this article we will discuss the general information about the Corporate Activity Tax and the impact it will have on rental companies.

Overview

In May 2019, Oregon enacted a new gross receipts based tax labeled the Corporate Activity Tax (CAT) in H.B. 3427 to raise approximately $1 billion in new revenue for public education. Although it is labeled the “Corporate” Activity Tax, it is really a “Commercial” Activity Tax. Meaning any commercial activity which is sourced to the State of Oregon (i.e. customer located in Oregon). The CAT is a calendar year tax and is effective beginning January 1, 2020, with the first Corporate Activity Tax Return due April 15, 2021. Some companies will be required to pay estimated payments beginning April 30, 2020.

The CAT is imposed on anyone who has Oregon Taxable Commercial Activity exceeding $750,000, although no tax is due until Oregon Taxable Commercial Activity exceeds $1,000,000. This means Partnerships, S Corporations, C Corporations, Sole Proprietor’s, Trusts & Estates and Individuals could all be subject to the CAT.

The CAT rate is 0.57% of the Oregon Taxable Commercial Activity on any amount over $1,000,000, plus a flat $250 tax. This is a tax imposed on the seller of the product, and not a tax imposed on the purchaser of the goods or services.

From January through March the Oregon Department of Revenue filed 17 draft administrative rules with the Oregon Secretary of State, and plan on making the final rules from April-June. So, what we know now may, and very likely will, change before the end of June 2020.

Oregon Gross Receipts (Taxable Commercial Activity)

The Oregon Corporate Activity Tax is due on gross receipts sourced to Oregon (Less: the allowable exclusions and deduction), also known as Oregon Taxable Commercial Activity. Oregon Commercial Activity is defined as the “total amount realized” by the taxpayer arising from transactions and activity in the regular course of the taxpayer’s trade or business that are sourced to Oregon (less: the allowable exclusions and deductions). Oregon excludes a number of specific items from Commercial Activity, including but not limited to; Receipts from the sale, exchange or other disposition of section 1221 or section 1231 assets, certain interest income, contributions of capital, sales of motor fuel, dividends, and income from a pass through entity. A full list of exclusions can be found in H.B. 3247, Section 58(1)(b). Note that Rental Activities are not excluded from the CAT tax.

Once a taxpayer exceeds $750,000 in Oregon Taxable Commercial Activity, they must register with the Oregon Department of Revenue. The penalty for not doing so is $100 per month up to $1,000 total for failing to register.

Cost or Labor Subtraction

Taxpayers are allowed a deduction of 35% of the greater of 1) Cost Inputs as defined as Cost of Goods sold on the federal income tax return under IRC 471 or 2) Labor Costs as defined as total compensation of all employees, not to include compensation paid to any single employee in excess of $500,000.

The Cost or Labor Subtraction must be apportioned to Oregon, based on the percentage of Oregon Apportioned Sales to Total Gross Sales. This percentage will be applied to the 35% of Cost or Labor inputs to calculate the allowable deduction in calculating Oregon Taxable Commercial Activity.

The Calculation

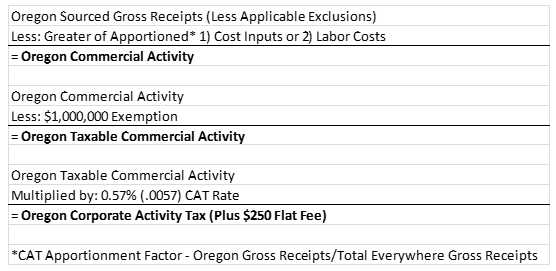

The simple calculation for the CAT is:

Rental Company Considerations

Rental Income is subject to the New CAT Tax beginning January 1, 2020. Rental Property is sourced to Oregon if the property is located in Oregon.

Currently, there has not been any guidance from the Oregon Department of Revenue for what (if any) costs related to Rental Properties will qualify as “cost inputs”. Thus, rental companies may be only allowed the deduction for payroll costs incurred. Stay tuned for additional guidance to be issued related to Rental Expenses.

Unitary Groups

The Oregon Department of Revenue defines a ‘taxpayer’ to include a “unitary group”. The Oregon CAT provides that a Unitary Group must register, file and pay as a single taxpayer and may exclude receipts from transactions amongst its members.

The definition of a “Unitary Group” is fairly straightforward. To be considered a “Unitary Group” the following two tests must be met:

- A group of entities or persons with MORE THAN 50% common ownership (indirect or direct) and;

- Centralized Management function or an integrated business.

Passing it through

Many companies plan to pass through the tax in some form to customers. This passing through of the tax can be complex, due to the deduction and exemption allowed. Meaning that companies will not know the ultimate amount due until the calendar year has been completed. In addition, amounts passed through to customers may themselves be included in the total gross receipts subject to the tax (thus a “CAT on CAT” potential).

Commercial rental companies will want to discuss potentially passing through the CAT on invoices, with legal counsel to determine the best way to legally do so.

Estimated Payments

Estimated Tax Payments will be due Quarterly (4/30, 7/31, 9/30 and 12/31) for companies or unitary groups with an estimated total CAT liability of $10,000 or more. This equates to about $1,720,000 of Oregon Taxable Commercial Activity (or $2,720,000 of Gross Receipts with no subtractions)

Resources & Contact

If you have any questions, we’re here to help.

Contact Brian Kottek, CPA at Brian@Fhjacpas.com or 503-378-0220.

This article is from a recent issue of The CRE Profit Insider™, which is published by: Pikes Northwest, LLC. Office Address: Pikes Northwest, LLC, Specializing in Commercial Property Management 698 12th St SE Ste 140, Salem, OR 97301 Phone: 503/588-3586 Fax: 503/361-8546 Newsletter Editorial Advisory Board: Jerry A. Jones, Commercial Property Manager & Broker Licensed in the State of Oregon Chris Matheny, Attorney, Advisor to Developers, Brokers & Investors Tom Cowan, Owner @ Pikes Northwest, newsletter Contributor, Private Investor, Business Owner

My name is Alyssa Flores. I was raised here in Salem, Oregon. I’ve been working in property management for the past 6 years, and am excited to be part of the Pikes Northwest team. In my spare time I enjoy being with my family and friends.

My name is Alyssa Flores. I was raised here in Salem, Oregon. I’ve been working in property management for the past 6 years, and am excited to be part of the Pikes Northwest team. In my spare time I enjoy being with my family and friends. My experience in property management spans 15 plus years including selling homes in Southern CA. I relocated back to the NW after 20 plus years and I’m really enjoying the beauty of the seasons! I’m excited to add more Commercial Property Management experience to my skill set!

My experience in property management spans 15 plus years including selling homes in Southern CA. I relocated back to the NW after 20 plus years and I’m really enjoying the beauty of the seasons! I’m excited to add more Commercial Property Management experience to my skill set!